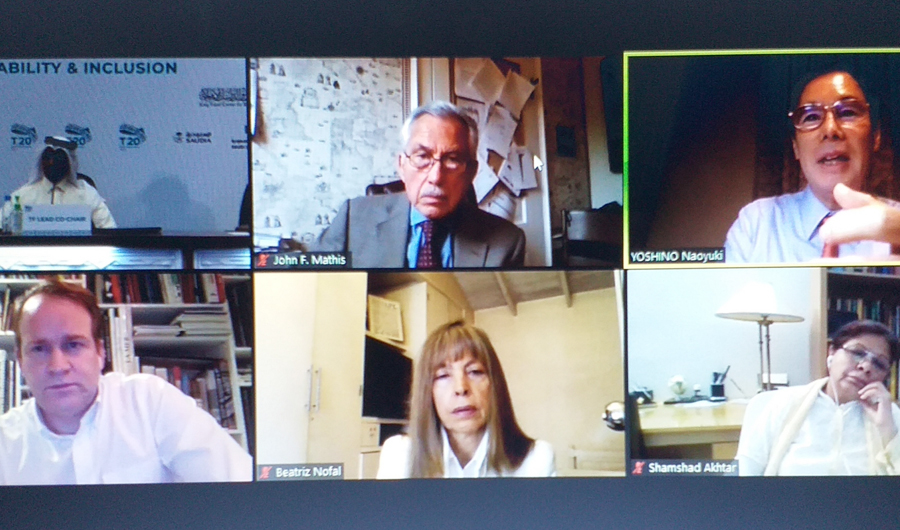

RIYADH: The G20’s Think20 (T20) engagement group met on Tuesday to discuss the challenges nations face in developing infrastructure, and ways in which investment in the sector can be encouraged.

The aim of “Infrastructure Investment and Financing,” the latest in a series of T20 webinars, was to highlight the barriers to, and opportunities for, improving public and private investment in infrastructure, and identify changes to public policy that are necessary to attract more investors.

Participants explored the essential role of the private sector in providing long-term finance, and considered innovative frameworks that could help bridge infrastructure-investment gaps within and among countries. They also attempted to identify and evaluate infrastructure needs and opportunities for investment, based on efficiency, sustainability and economic development.

In his opening remarks, Raja Al-Marzoqi, the lead co-chair of the event and a faculty member at the Institute of Diplomatic Studies, said that public and private investment in infrastructure is necessary to meet increasing global demand for infrastructure, and to reduce the infrastructure gap between advanced and emerging economies.

Pakistani economist Shamshad Akhtar, the webinar co-chair and a former UN undersecretary, said a number of countries need better access to basic services, and global connectivity needs to be improved.

Instead of talking about “infrastructure investment,” she said there is a need to focus on sustainable infrastructure investment. Financing such projects and promoting climate-resilient and sustainable infrastructure investment remain key challenges, she added.

Akhtar welcomed the G20’s debt-relief initiative for poorer countries as they wage an economic battle against the effects of pandemic but stressed the need to do more to overcome the challenges they face, including high levels of debt.

“There is a need to prioritize innovative frameworks to bridge the infrastructure-investment gap, promoting infrastructure investments that are resilient, sustainable and can adjust to climate effects, technology innovation for smart cities, and challenges of rapid urbanization,” she added.

Tetsushi Sonobe, the dean and CEO of the Asian Development Bank Institute, said that to help achieve infrastructure objectives there is a need to enhance financial support to micro, small and medium-sized enterprises. To attract private investment, however, the rate of return on such financing must be increased, he added, and research and international cooperation would help mitigate the challenges.

John Mathis, the president of TCAS Inc. and editor of the Journal of Private Equity, noted that the pandemic has affected infrastructure investment. He highlighted the importance of the G20 emergency reserve fund and the growing role it will play in infrastructure investment and financing.

“We recommend that the G20 infrastructure working group includes a systematic and multiscale review of nature-based solutions through the infrastructure cooperation platform, with a focus on designated post COVID-19 recovery initiatives,” said Nicolas Buchoud, president of the Grand Paris Alliance think tank and a fellow of the Global Solutions initiative, a collaborative enterprise that suggests policy responses to global problems.

At the end of the webinar, Saudi artist Abdul Aziz Al-Najim presented the group with a work he created based on the themes of infrastructure, investment and financing.

The T20 also welcomed the recent endorsement by G20 energy ministers of the circular carbon economy (CCE) framework for more-sustainable energy systems. The CCE concept, which was proposed to the G20 by Saudi Arabia, is a holistic, integrated, inclusive and pragmatic approach to managing emissions.

It offers a new way of addressing climate change mitigation goals that values all options and encourages all efforts to reduce the accumulation of carbon in the atmosphere through the “4Rs:” reduce the amount of carbon, reuse it to create valuable feedstocks and fuels; recycle it through the natural carbon cycle; and remove excess amounts from the atmosphere.

Hydrocarbons still account for 82 percent of G20 energy supplies, a figure that has remained relatively stable since 1990. G20 member countries must solve the problem of carbon accumulation in the atmosphere if the world is to stay below the Paris Agreement’s warming thresholds.

The T20 said that achieving the accord’s target of limiting the average global temperature rise to less than 2 degrees Celsius above preindustrial levels — let alone its aspirational target of a 1.5 degree increase — will require the participation of hard-to-abate industries in efforts to mitigate greenhouse gases. Climate change mitigation targets cannot be achieved without first reaching emissions neutrality, which will require a significantly ramped-up effort to deploy and use negative emissions, the group said. It is essential that these industries are included in mitigation policies that address the transition to cleaner energy systems in an effort to achieve carbon neutrality in the second half of the century.

Coordinated G20 efforts are vital to the pursuit of this goal, and post-pandemic economic-recovery stimulus packages, especially hydrocarbon bailouts, must be built around a circular carbon economy framework, the T20 said.

The group called for a renewed commitment to addressing climate change by embracing all mitigation-technology options in an effort to progress toward sustainability. Specifically, it called on G20 governments to “build back better” after the pandemic through green and sustainable economic-stimulus packages. Stimulus priorities must not derail clean-energy targets and climate goals but must support innovations in carbon-management technologies, including negative-emission technologies such as direct air capture.

Saudi Arabia holds the presidency of the G20 this year and the group’s annual summit is due to be held in Riyadh in November. The T20, a network of think tanks and researchers, is one of several independent G20 engagement groups led by organizations from the host country. They focus on different sections and sectors of society and work to develop policy recommendations that are presented to G20 leaders for consideration.

from Saudi Arabia https://ift.tt/2EJW70y

0 Comments:

Post a Comment